Expert Buying Agent Services in Woodbridge You Can Count On

I've been working as a real estate agent helping buyers find homes throughout Northern Virginia since 1989. After more than three decades in this business, I still get excited when clients find the right property in places like Lake Ridge, Potomac Mills, or anywhere else in the Woodbridge area.

Call Matt

The Northern Virginia market moves fast, and having someone who knows how things work around here makes a real difference when you're trying to buy. Whether you're looking at single-family homes in Marumsco, townhomes near the VRE station, or condos in Dale City, my buying agent services help you figure out what's actually available and what you can realistically get within your budget.

Working with a buyer's agent means you have someone handling everything - finding properties that fit what you need, scheduling showings, writing offers, negotiating terms, dealing with inspections. Some folks want to be near good schools in areas like Rippon Landing. Others care more about their commute to DC or quick access to I-95. I help you sort out what matters most and then make it happen.

The Greater DMV market has changed plenty over the years, but one thing stays the same - buyers who have a real estate agent working for them usually end up with better deals and way less headache than people trying to handle everything on their own.

Figuring Out What You Can Afford and What You Actually Want

Before we start looking at houses, we need to sit down and talk through what you're really after and what makes sense money-wise. I've seen too many buyers waste time looking at places they can't afford or chasing houses that don't match what they actually need.

First thing is getting you pre-approved with a lender who knows the Northern Virginia market. Not pre-qualified - pre-approved. There's a big difference. Pre-approval means a lender has actually looked at your finances and committed to lending you a specific amount. That matters when you're competing against other buyers in places like Occoquan or Triangle.

Then we go through what you're looking for. How many bedrooms, whether a yard matters to you, if you're fine with a condo where the HOA deals with the landscaping. Schools might be your top priority, or maybe you just need to be closer to Quantico or Fort Belvoir so you're not spending half your life on I-95. A lot of people working from home these days need actual office space - not just a desk shoved in the corner of their bedroom.

Here's where buyers get themselves in trouble. They walk into an open house, see granite counters and hardwood floors, and suddenly that's the house they want. Then they're either stretching to afford it or they're giving up the neighborhood they actually wanted. Maybe it's farther out from work than makes sense. Maybe the kitchen looks great but now they're adding time to their commute every single day. The Consumer Financial Protection Bureau's homebuying toolkit provides helpful guidance on understanding what you can afford and navigating the mortgage process. We talk through this stuff before you fall in love with the wrong place.

Finding Properties You Won't See on Zillow

Once we know what you're looking for and what you can spend, I get you set up on the MLS so you're seeing listings as soon as they hit the market. Not three days later when everyone else in Northern Virginia has already scheduled showings - you see them right away.

Zillow and those other sites are fine for browsing, but they're slow. By the time a house shows up there, serious buyers with agents have already seen it. In neighborhoods like Lake Ridge or anything near the VRE stations in Woodbridge, good properties move fast.

According to the Northern Virginia Association of Realtors, homes in our region continue to sell quickly with strong buyer demand. You need to be in that first wave of people looking, not showing up after five other buyers have already made offers.

I also know which neighborhoods are worth your time and which ones have issues you won't see from looking at listing photos online. Some areas flood when we get heavy rain. Others back up to I-95 and you'll hear traffic noise constantly.

There are streets in Manassas where everything looks fine until you realize the commute is worse than you thought, or the schools aren't what you were hoping for.

I've been doing this since 1989, so I've watched neighborhoods in Dale City go up in value while other parts stayed flat. Same thing in Stafford - some areas are getting new development and better amenities, others aren't changing much. You pick up on this stuff after 35 years of watching what sells and what sits on the market.

Actually Looking at Houses and Figuring Out What's Worth It

Once we find some places that seem like they might work, we go see them. Pictures online make everything look perfect - you walk in and it's a different story. Maybe the layout's weird, maybe the street's noisier than you expected, maybe the whole place just feels off somehow.

I handle the scheduling with listing agents and work around whenever you're free. Evenings, weekends, whatever.

Something comes up that looks good and we can usually get in there fast, same day if we need to.

While we're walking through, I'm checking for foundation cracks, ceiling stains from leaks, that sort of thing. HVAC systems that look ancient. Roofs that are obviously near the end.

'

Yeah, you'll get an inspection later, but it helps to spot the big stuff early so you're not falling in love with a kitchen when the house needs $30,000 in repairs you weren't planning on.

You'll end up seeing houses in different spots - maybe something in Potomac Shores, then a place over in Triangle for comparison.

Price might be close but the neighborhoods don't feel the same when you're actually there.

Commute's different, schools are different. You can't really tell any of that from scrolling through listings at home.

Writing Offers That Actually Get Accepted

Finding a house you want is one thing. Getting the seller to accept your offer is another, especially in Northern Virginia where you're usually competing against other buyers.

I look at what similar houses have sold for recently in that neighborhood - not what they were listed at, what they actually closed for. That tells us what the market's really doing.

A house in Gainesville might be priced at $450,000, but if three similar places sold for $430,000 in the past month, we need to talk about whether offering full price makes sense or if we should come in lower.

The offer isn't just about price. There's earnest money, how long you need for financing, inspection contingencies, when you can close. Sellers care about all of it.

Maybe they need to close fast because they're relocating for work. Maybe they want to stay in the house for 30 days after settlement while they find their next place. We can use that stuff to make your offer more attractive even if you're not the highest bidder.

If there are multiple offers - and there often are in popular areas like Woodbridge or Manassas - we need to be strategic. Sometimes waiving the inspection isn't smart even if it makes your offer stronger. Sometimes offering to cover the appraisal gap helps. Sometimes it comes down to writing a letter about why you love the house, though honestly that doesn't work as often as people think it does.

I've written hundreds of offers over the years. Some get accepted right away, some go back and forth with counteroffers, some fall apart. The key is knowing when to push and when to walk away because the deal doesn't make sense for you. For military buyers, VA home loan benefits can provide significant advantages during the offer process, including no down payment requirements and more flexible terms.

Making Sure You Know What You're Buying

Once your offer gets accepted, the inspection period starts. This is when you find out if the house has problems the seller didn't mention or you didn't spot when we were looking at it.

I work with inspectors who know Northern Virginia homes. They understand what to look for in older houses in areas like Occoquan versus newer construction in places like Potomac Shores.

Foundation issues from our clay soil, roof problems, electrical panels that need upgrading, plumbing that's outdated - they check all of it.

The inspection report's going to list everything wrong with the house. Loose handrail, dripping faucet, stuff like that.

Then there's the bigger stuff - water heater that's about done, HVAC that's not working right, signs of water getting into the basement.

We sit down with the report and talk through what actually matters. A loose handrail? Whatever. A roof that needs replacing in the next year or a septic system with problems? That's real money you're about to inherit. Maybe we ask the seller to fix it before closing.

Maybe they give you a credit so you can handle it yourself. Maybe they knock some money off the price.

Depends on the situation and how bad the problems are.

The appraisal happens around this time too. If the appraiser says the house is worth less than you're paying, we have to figure that out with the seller. Either they lower the price, you pay the difference in cash, or you meet somewhere in the middle.

Getting You to Settlement Without Problems

The last few weeks before closing can get chaotic with all the different deadlines and paperwork that needs to happen. The lender needs updated documents, the title company needs insurance information, the seller wants to change the closing date - there's always something.

I stay on top of all this so things don't fall through at the last minute.

Your lender needs another pay stub? I'm making sure you get it to them. Title company found a lien that needs clearing? I'm working with the seller's agent to get it handled. Seller wants to push closing back a week? Depends if that messes up your plans or if it's fine.

Day or two before settlement, we go back to the house and walk through it again. Making sure it looks the same as when you made your offer.

Sellers sometimes leave stuff they weren't supposed to - furniture, boxes of junk in the garage. Or an appliance that was staying is gone. You want to know about it before you own the place.

Settlement day, you're signing papers for what feels like forever. The settlement agent goes through each document, and I'm sitting there making sure the numbers look right and everything matches what we negotiated.

The Consumer Financial Protection Bureau's closing process guidance explains what to expect during this final step. If something's off, we stop and fix it before you sign.

Once everything's done and the money goes through, you get the keys. The house is yours and you can look forward to moving in soon.

Time to Stop Scrolling and Start Looking for Real

You've probably been looking at houses online for a while now. Zillow, Realtor.com, all of it. Maybe you're not sure what you can actually afford in Northern Virginia, or you keep seeing places you like but they're already under contract by the time you try to schedule a showing.

I've been doing this in Woodbridge and all over the area since 1989.

My buying agent services mean you get access to listings faster, you know what neighborhoods are actually worth your time, and you have someone writing offers that sellers take seriously.

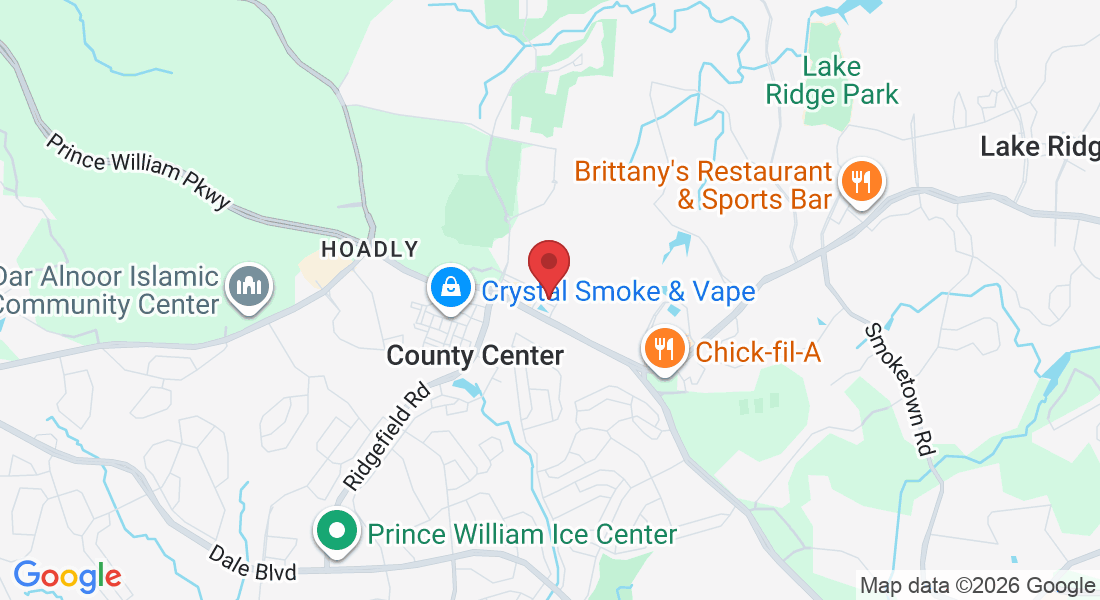

My office is at 4500 Pond Way in Woodbridge, but we can meet wherever makes sense for you.

The first conversation is just going over what you're after and seeing if buying right now works for your situation.

Call me at (703) 380-9042 or email [email protected]. Let's figure out how to get you into a house that actually works for you.

Call Matt

Our Location and Business Information

Address, Email & Phone

Address:

4500 Pond Way Ste 100

Woodbridge, VA 22192

USA

Phone Number: (703) 380-9042

Hours of Operation