First-Time Home Buyer Services in Woodbridge

I've been helping first-time buyers in Woodbridge and all over Northern Virginia figure out homeownership since I started Matt Huggins Real Estate back in 1989. After more than three decades in this business, I still love seeing folks get their first set of house keys.

Call Matt

Here's the thing about buying your first home in our area: the Northern Virginia market moves fast, and it can feel overwhelming when you're trying to compete with seasoned buyers around Lake Ridge, Potomac Mills, or the historic Woodbridge town center.

But that's exactly why our real estate agency focuses on first-time home buyer services - because everyone deserves a fair shot at homeownership, even if you've never been down this road before.

I understand that the home buying process throws a lot at you. Pre-approval paperwork, inspection reports, contract negotiations - it's a lot to juggle when you're already trying to figure out which neighborhoods fit your budget and lifestyle. Some folks want condos near the VRE station for the commute convenience.

Others are drawn to single-family homes in areas like Marumsco or Rippon Landing where the schools have good reputations.

What I bring to the table is three decades of watching this market change, plus the patience to walk you through every step without making you feel like you should already know this stuff.

My first-time home buyer services aren't about pushing you into the most expensive house you can qualify for - it's about finding the right fit for your life and your budget in the Greater DMV area.

Whether you're looking at starter homes in established neighborhoods or trying to get into one of the newer communities in Prince William County, we'll figure out a game plan that makes sense for you.

Getting Your Bearings: What Every First-Time Buyer Needs to Know

If this is your first time buying a home, it likely feels like you're learning a foreign language right now. Terms like "earnest money," "appraisal contingencies," and "settlement statements" get thrown around like everyone should know what they mean. That's where I step in.

During our initial consultation, we'll sit down and go through the entire process from start to finish. No question is too basic - I've heard them all over the years.

How much house can you really afford? What's the difference between getting pre-qualified and pre-approved? How long does this whole thing typically take in Northern Virginia's market?

I break down the timeline so you know what to expect. In our area, it usually takes 30-45 days to close once you have a contract, but finding the right house can take anywhere from a few weeks to several months depending on your budget and what you're looking for.

The key is understanding that this isn't just about finding any house - it's about finding your house in a market that includes everything from starter townhomes in Dale City to single-family homes in established neighborhoods like Occoquan or Triangle.

We'll also talk about the real costs involved beyond just the down payment, because nobody likes surprises when they're about to make the biggest purchase of their life.

Getting Your Money Right: Financing That Actually Works

Here's something most first-time buyers don't realize until they're knee-deep in house hunting - not all pre-approvals are created equal.

Some lenders will give you a number that looks great on paper but falls apart when you actually try to buy something in Northern Virginia's competitive market.

I work with local lenders who understand our area and can move fast when we need them to.

They know the difference between financing a condo in Woodbridge versus a single-family home in Stafford, and they won't leave you hanging when it's time to close.

We'll go through your options - conventional loans, FHA, VA if you qualify, and some of the first-time buyer programs that can help with down payments or closing costs.

Virginia has some decent programs for first-time buyers, and Prince William County sometimes has additional assistance available.

The Virginia Department of Housing and Community Development offers down payment assistance up to $50,000 for qualifying first-time buyers, which can make a huge difference when you're trying to get into the market.

The goal isn't just getting approved for the biggest loan possible.

It's figuring out what payment you can actually live with month after month, especially when you factor in property taxes, insurance, and HOA fees if you're looking at townhomes or condos.

The lenders I work with will give you the real story about what you can handle payment-wise, not just the maximum loan amount they can approve. Those are two totally different things.

One keeps you comfortable in your new home, the other might have you feeling "house poor" for the next five years just to make the mortgage payment.

Finding Your Needle in the Haystack: Smart Home Shopping

Once we know what you can afford and what you're looking for, the real fun begins. But here's the thing - scrolling through Zillow at 2 AM isn't the same as actually knowing what's available and what's worth your time.

I set you up on the MLS so you see new listings as soon as they hit the market, not three days later when half of Northern Virginia has already seen them – speed is the name of the game in the DMV.

In our market, the good stuff moves fast, especially in popular areas like Lake Ridge or anything near the VRE stations.

We'll start by driving through different neighborhoods so you can get a feel for the area beyond just the photos online.

There's a big difference between a house that looks great in pictures and one that backs up to I-95 with constant traffic noise. Or a place that floods every time we get a heavy rain - and trust me, we get some heavy rains around here every once and a while.

I help you figure out what's negotiable and what's not. Maybe you can live with outdated bathrooms if the bones of the house are solid and the neighborhood is right.

Or maybe having a dedicated space to work from home is non-negotiable for your situation.

What you really need might be an extra bedroom or a reasonable drive to work, but then you walk into a place with granite counters and suddenly you're second-guessing everything.

I help you stick to what actually works for how you live instead of falling for the first pretty house we see. The Prince William County First Time Homebuyer Program can provide up to 30% down payment assistance plus closing cost help, so we'll make sure you understand all your options before making any decisions.

Making Your Move: Offers That Get Accepted

Writing an offer that actually gets accepted in Northern Virginia takes more than just picking a number and hoping for the best.

Sellers around here usually have options (unless it's a buyers' market), especially in desirable areas like Occoquan or anything with decent schools.

I help you put together competitive offers that don't leave you broke or regretful six months down the road. That means understanding what matters to the seller - sometimes it's not just about offering the highest price.

Maybe they need a quick closing because they're relocating for work. Maybe they want to stay in the house for 30 days after closing to line up their next place.

We'll look at recent sales in the neighborhood to see what similar houses have been selling for, but we also need to factor in what's happening right now.

Is inventory low? Are there multiple offers on everything? Is it January when nobody wants to move?

The inspection contingency, appraisal contingency, financing timeline - all of these things matters when you're competing against other buyers.

I walk you through what you can reasonably ask for and what might kill your chances of getting the house.

Sometimes we'll lose out on a house, and that's okay. Better to lose out than to overpay by $50,000 or waive inspections on a place that turns out to need a new roof. There's always another house, but you can't undo a bad purchase decision.

Lifting the Hood: What You Need to Know Before You Buy

Getting a home inspection isn't just about checking a box - it's your chance to find out what you're really buying before you hand over a check for likely the biggest purchase of your life.

I work with inspectors who know Northern Virginia homes inside and out.

They understand the difference between a 1980s split-level in Montclair that might have foundation issues from our clay soil and a newer townhome in Potomac Shores where the main concerns are usually cosmetic.

The inspection report is going to list everything from minor stuff like loose doorknobs to bigger problems like HVAC systems that are on their last legs.

My job is helping you figure out what's normal wear and tear versus what's going to cost you serious money down the road.

Maybe the inspector finds that the roof needs replacing in the next few years, or the electrical panel is outdated. We can ask the seller to fix it, credit you money at closing, or you can decide if you want to handle it yourself after you move in.

If the problems are going to cost more than you can handle, we might decide to walk away from the deal completely (ultimately, that's up to you).

At the end of the day, every house has something wrong with it - that's just reality. Especially in Northern Virginia where you've got houses from the 70s and 80s mixed in with brand new construction.

The important question is whether you're looking at normal fix-up stuff or major repairs that are going to eat up all your money for years to come.

Crossing the Finish Line: Getting to Your Keys

When you get close to closing, things can feel pretty hectic with all the different deadlines and paperwork flying around. Don't worry - that's how it goes for everyone, even for folks who aren't first-time buyers.

I stay on top of everything so you don't have to.

Your lender needs updated pay stubs? I'll remind you.

The title company needs proof of homeowner's insurance? I'll make sure it gets to them.

What about when the seller decides they want to delay closing by a week? I handle those headaches for you.

We'll do a final walkthrough of the house a day or two before closing to make sure everything is in the same condition as when you made your offer.

Sometimes sellers leave behind more junk than they should, or maybe that dishwasher that was supposed to stay is suddenly missing.

Better to catch these problems before you sign the papers.

At the actual closing, you'll be signing what feels like 500 documents. I'll explain what each stack of papers is for and speak up if something doesn't look right.

The settlement agent runs the show, but I'm sitting right there in your corner, making sure everything matches up with what we negotiated.

When you finally get those keys in your hand, you'll officially own a piece of Northern Virginia real estate - worth all the paperwork and stress to get there.

Ready to Start House Hunting? Let's Talk About Your Goals

If you're tired of wondering whether homeownership is actually possible in Northern Virginia, let's sit down and figure out a real plan.

I've been helping first-time buyers navigate this market since 1989, and I know exactly what it takes to get you from rental payments to mortgage payments without losing your mind in the process.

I handle home sales throughout Northern Virginia - Woodbridge, Dale City, Stafford, Manassas, you name it. Some folks want condos because they don't want to deal with yard work and the VRE makes their commute easier.

Others want a house with some space so they're not hearing every footstep from the people upstairs. Whatever works for your situation and your wallet.

All we're doing at first is talking through what you want and what's actually doable in this market. I'm not going to try to sell you on anything – if it doesn't work for you, it doesn't work for me.

My goal every time is to give you the real story about what it takes to successfully buy your first home on your terms.

Give me a call at (703) 380-9042 or shoot me an email at [email protected].

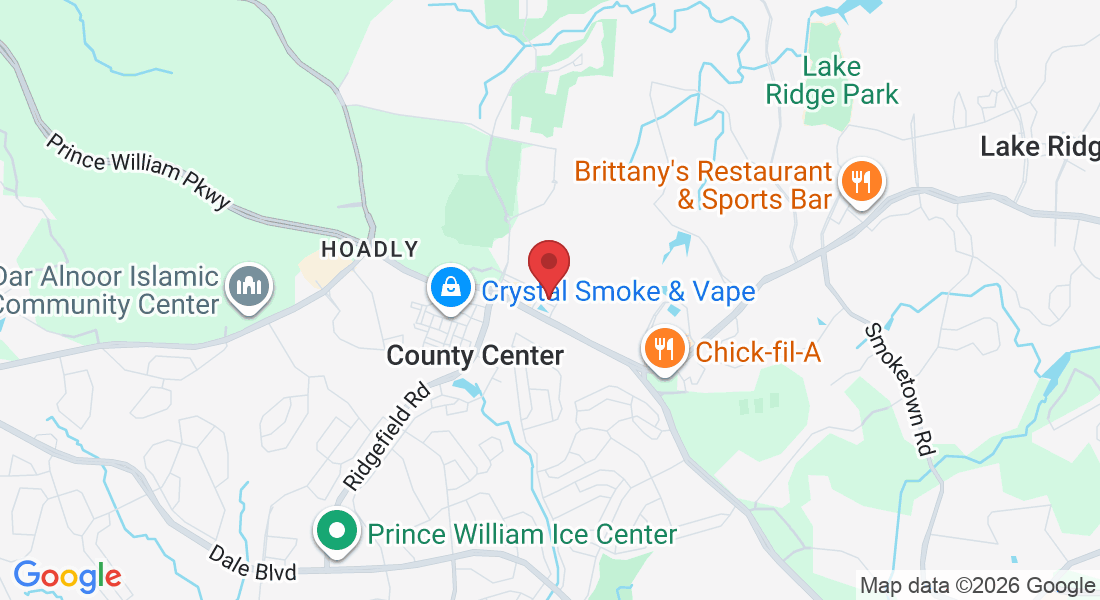

We can set up a time to meet at my office at 4500 Pond Way in Woodbridge, or I can come to you if that works better.

Call Matt

Our Location and Business Information

Address, Email & Phone

Address:

4500 Pond Way Ste 100

Woodbridge, VA 22192

USA

Phone Number: (703) 380-9042

Hours of Operation